A Theoretical Magic Money Circuit: Tracking Local Trading Loops

Based on my experience on compiling and managing the ESTA to ESTA trades spreadsheet a couple of things have now become obvious, and I think its worth sharing them.

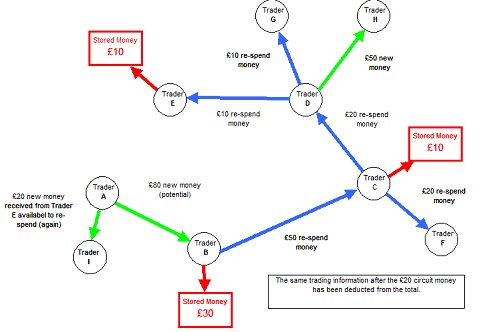

First: My analogy that the money supply acts in the same way that an electric circuit operates makes it clear that we can see the problem of money circulation primarily as a wiring and flow problem with each agents account acting like a node variously serving as a capacitor and a resistor (battery).

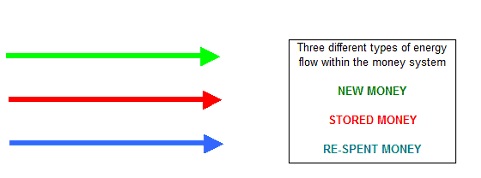

The three colours I chose for the three types of money are not arbitrary:

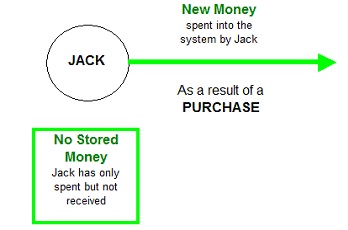

Green represents new money because it represents fresh growth, which in a natural plant based system tends to be green. It just arrives like magic from somewhere else.

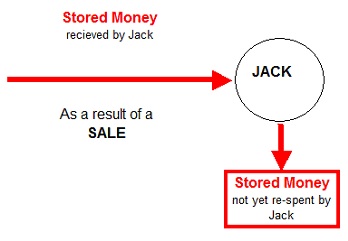

The choice of red for money held onto is a deliberate subversion of the common notion that an account in debt is in the red and an account with money in it is in the black.

First: My analogy that the money supply acts in the same way that an electric circuit operates makes it clear that we can see the problem of money circulation primarily as a wiring and flow problem with each agents account acting like a node variously serving as a capacitor and a resistor (battery).

The three colours I chose for the three types of money are not arbitrary:

Green represents new money because it represents fresh growth, which in a natural plant based system tends to be green. It just arrives like magic from somewhere else.

The choice of red for money held onto is a deliberate subversion of the common notion that an account in debt is in the red and an account with money in it is in the black.

There are three components to generating local wealth: money flows looping back on themselves to create completed circuits, the volume of money passing through the system and the frequency with which money passes through the system.

Thus spending money on through a highly networked trading system, with the increased expectation that it will come back to you, which in conventional economics is pushing one towards the red, is a greater economic virtue than simply sitting on it, and staying in the black in conventional terms.

Therefore I made Stored Money, or money coming in that has not (yet) been re-spent red. Technically red money can also represent money that has been spent outside of the system but, because they local spending system only records money that stays in the system ‘it’ does not know, and does not need to know the current status of the red money.

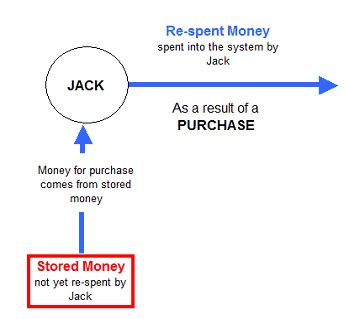

Conversely, unless 100% of a trader’s income is coming from the local trading system they will always have income from other sources which could be re spent into the system to ‘top up’ their red pot. Therefore money received from someone else within the system always remains virtual money ready to be re-spent (Red Money)

Finally we have blue money that, like green money, is money that is spent into the system. Unlike green money that is completely new money, money gets coloured blue when it comes out of the red money total. Therefore blue money is the actual re spend total.

Thus spending money on through a highly networked trading system, with the increased expectation that it will come back to you, which in conventional economics is pushing one towards the red, is a greater economic virtue than simply sitting on it, and staying in the black in conventional terms.

Therefore I made Stored Money, or money coming in that has not (yet) been re-spent red. Technically red money can also represent money that has been spent outside of the system but, because they local spending system only records money that stays in the system ‘it’ does not know, and does not need to know the current status of the red money.

Conversely, unless 100% of a trader’s income is coming from the local trading system they will always have income from other sources which could be re spent into the system to ‘top up’ their red pot. Therefore money received from someone else within the system always remains virtual money ready to be re-spent (Red Money)

Finally we have blue money that, like green money, is money that is spent into the system. Unlike green money that is completely new money, money gets coloured blue when it comes out of the red money total. Therefore blue money is the actual re spend total.

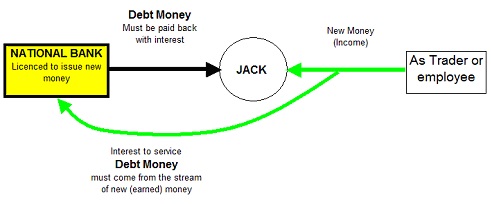

Because central banks have a monopoly on the issuing of legally recognised currencies control of the money supply is typically thought to reside with the banking system. In this system, which is the way in which the national and international banking systems are configured, New money is lent into the system by banks in the form of loans (debt) that must be paid back to the bank with interest. (debt+)

Over the last few decades, and especially since the deregulation of the banking system in the late 1980’s (The so called “Big Bang” ) debt repayments to service ever increasing loans has begun to increase wealth generated in the traditional way, by the application of human ingenuity to the creation of real goods (things) and real services (products that are essentially non-material)

In my economic modelling I call this bank-lent money Black Money, again to subvert the normal concept of what being in the black is traditionally thought to mean. In the current macro-system the only group that is always in the Black are the banks and their agents (unless the strain on making re-payments leads to a wave of mass-defaults as happened in 2008)

The net effect on real people operating in their local economy is that, to the extent that they are in any form of debt to the banking system, a portion of their newly generated income (Green Money) will be siphoned off by the banks and will leave the local economy on a one way trip out of the area.

This dynamic is clarified in the following illustration:

Over the last few decades, and especially since the deregulation of the banking system in the late 1980’s (The so called “Big Bang” ) debt repayments to service ever increasing loans has begun to increase wealth generated in the traditional way, by the application of human ingenuity to the creation of real goods (things) and real services (products that are essentially non-material)

In my economic modelling I call this bank-lent money Black Money, again to subvert the normal concept of what being in the black is traditionally thought to mean. In the current macro-system the only group that is always in the Black are the banks and their agents (unless the strain on making re-payments leads to a wave of mass-defaults as happened in 2008)

The net effect on real people operating in their local economy is that, to the extent that they are in any form of debt to the banking system, a portion of their newly generated income (Green Money) will be siphoned off by the banks and will leave the local economy on a one way trip out of the area.

This dynamic is clarified in the following illustration:

The original question I posed before devising the current local trading model was “If the current financial system (model) generates new money in the form of debt, which gradually sucks the life out of local communities, then what is the counter gesture to this?”

The answer that I arrive at was that of money traded into existence as local ingenuity and talent is applied to the creation of new goods and services. But this is only possible if the money stays within the system and loops back on itself, creating closed circuits.

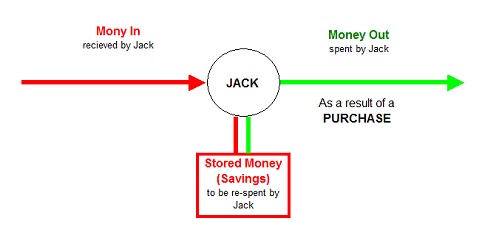

For many people the ‘common-sense’ perception of how money works in their everyday lives is illustrated by ‘pipe’ model, of a simple inflow and outflow.

The answer that I arrive at was that of money traded into existence as local ingenuity and talent is applied to the creation of new goods and services. But this is only possible if the money stays within the system and loops back on itself, creating closed circuits.

For many people the ‘common-sense’ perception of how money works in their everyday lives is illustrated by ‘pipe’ model, of a simple inflow and outflow.

This is referred to as a chain.

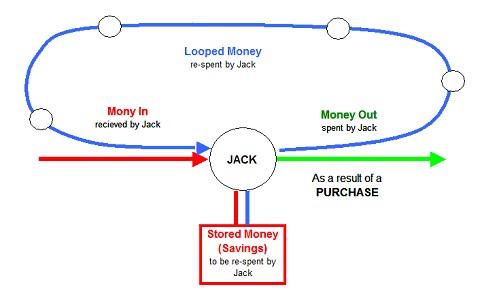

In contrast, this Local Trading model also contains loops, and seeks to maximise these loops and the frequency and volumes passing through them. For in real-wealth terms the money flowing through those loops not represents the creation of real values (goods and services) for real members of the local community. Every time a trader receives back some of the money they have previously spent then a closed loop has been created.

In contrast, this Local Trading model also contains loops, and seeks to maximise these loops and the frequency and volumes passing through them. For in real-wealth terms the money flowing through those loops not represents the creation of real values (goods and services) for real members of the local community. Every time a trader receives back some of the money they have previously spent then a closed loop has been created.

What is Blue Money?

Critically it is only when a closed loop is created, and the two ends if the input-output pipe are joined, that any new money is created at all. This new money is represented as an increase in group turnover.

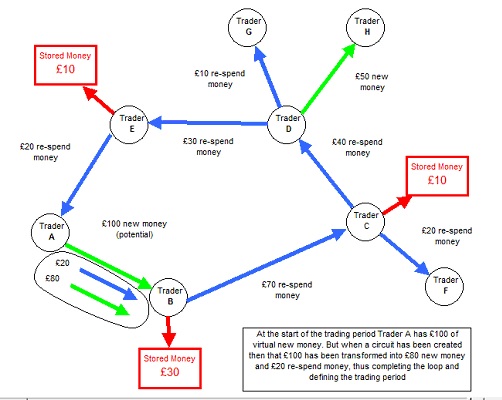

In the ESTA to ESTA trades spreadsheet model red money and green money always equal each other and balance each other out. This is what happens when one creates a chain that never loops back on itself.

If £100 is released into the system to trader A (£100 income) and they spend that £100 with trader B (expenditure) and so on all the way to Trader n the income (red money) and the expenditure (green money) always balance themselves out. Whilst the VOLUME of money in the system increases. (£1000 in and £1000 out, in the case of ten trades) there is no new money created.

It is only when the original money (green) spent by trader A returns to them from Trader n that the circuit is created. This is because; in a chain of spending someone has to have the money to start the spending process. If no one has any money then none of the trades will happen (unless money is lent into the system to get things going, which is the very system we want to avoid).

However, when trader A receives her money back via a trading loop something magical happens. N trades have taken place, as if no money needed to change hands but with all prices and values between the goods and services agreed. In other words, if the traders had the hindsight to know who was going to trade with who until such time as a loop was created (blue) they could have pre-arranged their trading cycle and exchanged their goods and services provided without the use of any money at all.

In the ESTA Trading spreadsheet it is only this blue circular (re-spent) money that creates additional turnover. But in reality, once a blue money circuit is completed it is effectively money that has been liberated from the flow of time.

All of the accounts in question have been re-set to zero by the amount that makes its way cleanly around the loop (and which is therefore identical to the £size of the loop) and yet any green money that facilitated the trading in the first place is still in the trading system, hence the reason why the money represented in a completed circuit is simultaneously liberated from the system and still available in the system. (And this is the reason why it represents increased turnover)

The trading period for the creation and completion of that loop is not defined by any external reference point but is internally defined by how long it takes to be completed.

Thus a loop of £100 taking its shortest rout back to Trader A might take a month and involve five trades. The value parameters of that loop would therefore be as follows:

Volume: £100

Number of traders involved: 5

Time to complete loop: 30 days

We could add to this an additional piece of date, namely the list of goods and services exchanged within the loop.

As has already been established, the smallest possible size that a trading loop involving currency can take is three traders. (Two does not need to involve currency because it can be a straight barter swap. This happens a lot between businesses and informally between friends and neighbours. One, if it remains one, is actually a gift and again, does not tend to come within the remit of formal economic systems.)

Critically it is only when a closed loop is created, and the two ends if the input-output pipe are joined, that any new money is created at all. This new money is represented as an increase in group turnover.

In the ESTA to ESTA trades spreadsheet model red money and green money always equal each other and balance each other out. This is what happens when one creates a chain that never loops back on itself.

If £100 is released into the system to trader A (£100 income) and they spend that £100 with trader B (expenditure) and so on all the way to Trader n the income (red money) and the expenditure (green money) always balance themselves out. Whilst the VOLUME of money in the system increases. (£1000 in and £1000 out, in the case of ten trades) there is no new money created.

It is only when the original money (green) spent by trader A returns to them from Trader n that the circuit is created. This is because; in a chain of spending someone has to have the money to start the spending process. If no one has any money then none of the trades will happen (unless money is lent into the system to get things going, which is the very system we want to avoid).

However, when trader A receives her money back via a trading loop something magical happens. N trades have taken place, as if no money needed to change hands but with all prices and values between the goods and services agreed. In other words, if the traders had the hindsight to know who was going to trade with who until such time as a loop was created (blue) they could have pre-arranged their trading cycle and exchanged their goods and services provided without the use of any money at all.

In the ESTA Trading spreadsheet it is only this blue circular (re-spent) money that creates additional turnover. But in reality, once a blue money circuit is completed it is effectively money that has been liberated from the flow of time.

All of the accounts in question have been re-set to zero by the amount that makes its way cleanly around the loop (and which is therefore identical to the £size of the loop) and yet any green money that facilitated the trading in the first place is still in the trading system, hence the reason why the money represented in a completed circuit is simultaneously liberated from the system and still available in the system. (And this is the reason why it represents increased turnover)

The trading period for the creation and completion of that loop is not defined by any external reference point but is internally defined by how long it takes to be completed.

Thus a loop of £100 taking its shortest rout back to Trader A might take a month and involve five trades. The value parameters of that loop would therefore be as follows:

Volume: £100

Number of traders involved: 5

Time to complete loop: 30 days

We could add to this an additional piece of date, namely the list of goods and services exchanged within the loop.

As has already been established, the smallest possible size that a trading loop involving currency can take is three traders. (Two does not need to involve currency because it can be a straight barter swap. This happens a lot between businesses and informally between friends and neighbours. One, if it remains one, is actually a gift and again, does not tend to come within the remit of formal economic systems.)

Michael Hallam

19 May 2014

19 May 2014