The Cost of Not Living

or How to be an Instant Drop Out Millionaire

or How to be an Instant Drop Out Millionaire

Our Ever Increasing Wealth

GDP (Gross Domestic Product) is supposed to be a measure of how a nations total accumulated wealth grows over time. The size of its economy. The inference is that the bigger the size of the economy the wealthier the members and players within that economy will be.

In 1955 total UK GDP, after adjusting for inflation, stood at £85 billion. At the end of the third quarter of 2013 the total stood at £382 billion. (source). At the end of 1995, when I bought my first house, UK GDP stood at £253 billion (adjusted). That means that our economy at the end of 2013 was half as big again compared with the economy of 1995 and that is taking into account the 'dip' caused by the 2008 financial crash.

So we should all, on average be half a rich as we were in 1995 right? Common sense dictates that this would give us 50% more spending power than we had in 1995. Well I remember 1995. It was the year that I managed to secure a mortgage and purchase a three bedroom semi detached house with garden for £40,000.

I was also the beneficiary, some years earlier of a free secondary education. Now we have a generation of under forties whose prospect of buying a house based upon the salary that they earn through working is non existent. And that is after they have paid £30,000 or more for their degree.

There seem to be a range of costs associated with life which just didn't exist in the past, (Think of the cost to customer of a CRB check or the fact that one now has to pay an estate agent fee for the privilege of renting a flat.) or if they did they were far less than they are today. Which parents in 1995 expected to pay out £100s on a prom dress when their daughter graduated from secondary school? Then there is the modern cost of a wedding event, estimated at £36,000 all in (source),

GDP (Gross Domestic Product) is supposed to be a measure of how a nations total accumulated wealth grows over time. The size of its economy. The inference is that the bigger the size of the economy the wealthier the members and players within that economy will be.

In 1955 total UK GDP, after adjusting for inflation, stood at £85 billion. At the end of the third quarter of 2013 the total stood at £382 billion. (source). At the end of 1995, when I bought my first house, UK GDP stood at £253 billion (adjusted). That means that our economy at the end of 2013 was half as big again compared with the economy of 1995 and that is taking into account the 'dip' caused by the 2008 financial crash.

So we should all, on average be half a rich as we were in 1995 right? Common sense dictates that this would give us 50% more spending power than we had in 1995. Well I remember 1995. It was the year that I managed to secure a mortgage and purchase a three bedroom semi detached house with garden for £40,000.

I was also the beneficiary, some years earlier of a free secondary education. Now we have a generation of under forties whose prospect of buying a house based upon the salary that they earn through working is non existent. And that is after they have paid £30,000 or more for their degree.

There seem to be a range of costs associated with life which just didn't exist in the past, (Think of the cost to customer of a CRB check or the fact that one now has to pay an estate agent fee for the privilege of renting a flat.) or if they did they were far less than they are today. Which parents in 1995 expected to pay out £100s on a prom dress when their daughter graduated from secondary school? Then there is the modern cost of a wedding event, estimated at £36,000 all in (source),

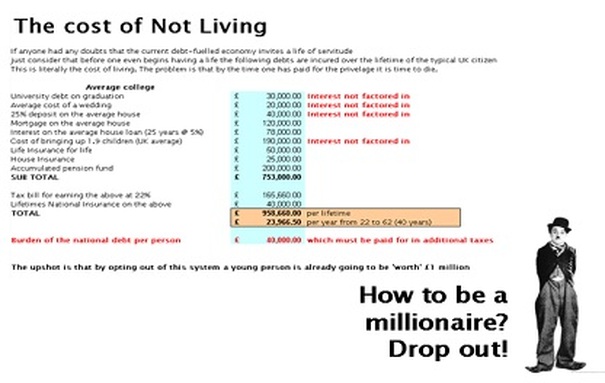

Some time ago I did a rough calculation of the cost of providing the things associated with ones passage through life before one begins to spend anything on actually living. Including pensions, tax, national insurance, mortgage, secondary education, life insurance, the cost of bringing up our 1,9 average children per couple and a few other 'essential' sundries my simple reckoning came to over £1 million over the course of a lifetime.

My conclusion and advice to any young person contemplating getting on the first fund of the social ladder? Don't! If you want to become an instant millionaire over the course of your lifetime actively try to avoid these costs or, where unavoidable, actively seek creative ways to drive them down and minimise them. Instead take some time to find out what you want to do with your life and seek out those people, businesses, groups and organisations that will help you do it.

If you insist on getting onto the ropey 'success' ladder do bear in mind that, whilst the top 1% of the human race might well own nearly 50% of global assets (and rising) you are very unlikely to join them and, if you are not creative and inventive in your own right, risk the danger of falling into the 50% who own next to nothing, or worse, own less than nothing because of their un-repayable debts, is growing by the day.

Michael Hallam

10 October 2014

My conclusion and advice to any young person contemplating getting on the first fund of the social ladder? Don't! If you want to become an instant millionaire over the course of your lifetime actively try to avoid these costs or, where unavoidable, actively seek creative ways to drive them down and minimise them. Instead take some time to find out what you want to do with your life and seek out those people, businesses, groups and organisations that will help you do it.

If you insist on getting onto the ropey 'success' ladder do bear in mind that, whilst the top 1% of the human race might well own nearly 50% of global assets (and rising) you are very unlikely to join them and, if you are not creative and inventive in your own right, risk the danger of falling into the 50% who own next to nothing, or worse, own less than nothing because of their un-repayable debts, is growing by the day.

Michael Hallam

10 October 2014