Its time for a New Economic System:

Moving away from a two-dimensional to a three-dimensional value system.

Michael Hallam - 26 July 2022

Moving away from a two-dimensional to a three-dimensional value system.

Michael Hallam - 26 July 2022

This article is aimed at those who think that there is clearly something wrong with our current financial-economic system and the incentives and mechanisms that underly it. I don’t intend to go into all the ways in which the current global financial system is broken (there are thousands of places you can go for that analysis) but rather suggest a way in which we might build a better system, from the ground up, that is kinder to people, the environment and the real needs of both.

The fundamentals of the current economic system

To begin with, and to keep it simple, I would like to suggest there are three primary components to the economic operating system, namely production, consumption and what is produced/consumed. In the simplest exchange models these are the two parties to the exchange and the two things that are exchanged between the parties. [1]

If we look at this from a slightly different angle we can say that there are three aspects to any economic event. [2] The creation of an item that meets a need, the existence of that item in a viably maintained state and the effective destruction of that item when it is ‘consumed’.

One example is a pint of milk. Several processes combine to create the item, including the provision of the bottle/carton. The product then stays in a viably preserved state until it is drunk (consumed and thereby destroyed). Insofar as the pint exists it is a manufactured asset offering the potential of needed nourishment at the point when it is eventually consumed. Whilst it exists as an asset it is subject to the dangers of damage or destruction before it achieves its purpose. i.e. we don’t drink it in time and it goes off, or we accidentally knock it on the floor and the bottle/carton smashes/splits and the milk inside becomes unusable. We will come back to this point later.

To summarise, we have three basic states for an artefact to be in: A production state, when it is being assembled, a maintenance state, when it is available for use as an asset, and a consumption state, when it is consumed or destroyed/transformed into something else. Creation correlates with production, whilst destruction correlates with consumption.

Some needs are one offs, like the need to be born, in order to be alive, with death being the moment when life is consumed and comes to an end. In one way we could see the act of being born, living and eventually dying as being the archetype of all production and consumption. The artefact, in this case, is having a physical body that is capable of sustaining life.

Many needs need to be met at repeated intervals, over time, and our more sophisticated artefacts provide for multiple uses. A kettle is a good artefact for meeting the need to have regular hot drinks, and a kettle might successfully contribute to the production of many hundreds of drinks before it reaches the end of its life. In this way a kettle serves as a good means of production for producing lots of hot drinks, and an asset in the easy making of hot drinks.

If our kettle breaks, or gets lost (when moving house), or we just don’t like the look of it anymore, then its no longer a good asset (for us) to make hot drinks and, should we wish to continue having regular conveniently produced hot drinks, we will need to obtain another one. In other, words a need is triggered that the current asset base cannot meet.

For this triggered need to be fulfilled we will need another kettle. The normal way of obtaining another one is to buy it from a place that sells kettles. (From a kettle market anyone?) Which means that someone must have anticipated our need and produced another kettle in anticipation of and readiness to meet that need. We now enter into the direct realm of production and consumption. In order for me to have the replacement kettle I must have something the seller wants in exchange, usually money, that will allow the seller to meet needs that they have.

The point of exchange, where there is a buyer and a seller, and a financial transaction is usually what is understood to be a classic economic act and the entire market infrastructure is build on top of numerous exchanges. In modern economic systems these exchanges of mutual value are usually expressed in terms of financial transactions, which can be tracked, via account ledgers, and the information generated from the sum total of these tracked financial transactions, along with the numerical value of those transactions, informs how the economy behaves.

To begin with, and to keep it simple, I would like to suggest there are three primary components to the economic operating system, namely production, consumption and what is produced/consumed. In the simplest exchange models these are the two parties to the exchange and the two things that are exchanged between the parties. [1]

If we look at this from a slightly different angle we can say that there are three aspects to any economic event. [2] The creation of an item that meets a need, the existence of that item in a viably maintained state and the effective destruction of that item when it is ‘consumed’.

One example is a pint of milk. Several processes combine to create the item, including the provision of the bottle/carton. The product then stays in a viably preserved state until it is drunk (consumed and thereby destroyed). Insofar as the pint exists it is a manufactured asset offering the potential of needed nourishment at the point when it is eventually consumed. Whilst it exists as an asset it is subject to the dangers of damage or destruction before it achieves its purpose. i.e. we don’t drink it in time and it goes off, or we accidentally knock it on the floor and the bottle/carton smashes/splits and the milk inside becomes unusable. We will come back to this point later.

To summarise, we have three basic states for an artefact to be in: A production state, when it is being assembled, a maintenance state, when it is available for use as an asset, and a consumption state, when it is consumed or destroyed/transformed into something else. Creation correlates with production, whilst destruction correlates with consumption.

Some needs are one offs, like the need to be born, in order to be alive, with death being the moment when life is consumed and comes to an end. In one way we could see the act of being born, living and eventually dying as being the archetype of all production and consumption. The artefact, in this case, is having a physical body that is capable of sustaining life.

Many needs need to be met at repeated intervals, over time, and our more sophisticated artefacts provide for multiple uses. A kettle is a good artefact for meeting the need to have regular hot drinks, and a kettle might successfully contribute to the production of many hundreds of drinks before it reaches the end of its life. In this way a kettle serves as a good means of production for producing lots of hot drinks, and an asset in the easy making of hot drinks.

If our kettle breaks, or gets lost (when moving house), or we just don’t like the look of it anymore, then its no longer a good asset (for us) to make hot drinks and, should we wish to continue having regular conveniently produced hot drinks, we will need to obtain another one. In other, words a need is triggered that the current asset base cannot meet.

For this triggered need to be fulfilled we will need another kettle. The normal way of obtaining another one is to buy it from a place that sells kettles. (From a kettle market anyone?) Which means that someone must have anticipated our need and produced another kettle in anticipation of and readiness to meet that need. We now enter into the direct realm of production and consumption. In order for me to have the replacement kettle I must have something the seller wants in exchange, usually money, that will allow the seller to meet needs that they have.

The point of exchange, where there is a buyer and a seller, and a financial transaction is usually what is understood to be a classic economic act and the entire market infrastructure is build on top of numerous exchanges. In modern economic systems these exchanges of mutual value are usually expressed in terms of financial transactions, which can be tracked, via account ledgers, and the information generated from the sum total of these tracked financial transactions, along with the numerical value of those transactions, informs how the economy behaves.

The Nature of the Problem

The principal way of defining the health of an economy has come to be represented in Gross Domestic Product (GDP) [3], which measure the total volume of the value of all the exchanges in the economy, and it is a cardinal rule of neo-classical economics that the way this GDP sum should be continuously growing and getting larger and larger with every accounting period. In neo-classical economics economic growth, thus defined, is the main, even the only goal of all economic management.

For this neo-classical economic system to be seen as working well, only two of the three elements outlined above need to be recognised, namely the producing/selling and the buying/consuming elements of the equation. Critically, for us, what happens to the assets that are produced and the role they provide in meeting needs is ignored, overlooked or, at worse, deemed to be irrelevant. As the fundamental basis of meeting needs is to have an effective working asset base and, as the fundamental purpose of an economy is to effectively meet needs, then to ignore the ongoing viability and state of the asset base is to effectively ignore the fundamental purpose of having an economy at all. To have a truly health economy we need to find the optimal relationship between the three economic elements, namely need, asset and the production of that asset, or production, hold, consume.

This distinction between a three-fold economic system and a two-fold system forms the basis of this analysis and underpins the proposal for the new economic system that will be outlined below.

But before we get there let’s explore some of the implications of the two-fold economic model a little further.

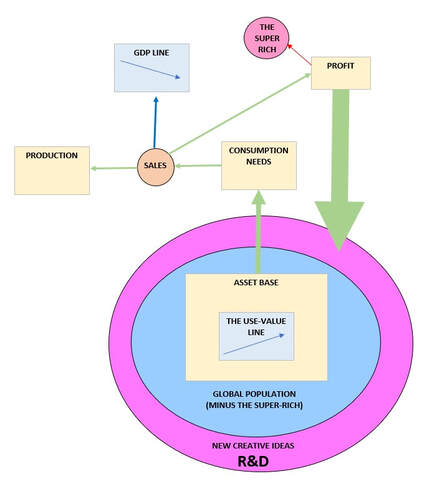

In the existing economic model, which I will characterise as the two-fold model, all that really counts is the amount of production and the amount of consumption and both of these are balanced at the point of sale. What happens to the items once sold is irrelevant and is largely ignored. All that really counts are volumes of sales and how much they contribute to the GDP line. [4]

If I buy a new kettle and trip on the way home and the kettle lands in the canal and I have to go back and buy a second new kettle that will add twice as much to GDP than if I had not had my little accident, and if the now useless first kettle had been happily working in my kitchen, rather than slowly rusting at the bottom of the canal. In other words, the successful preservation of useful assets and the need not to have them continuously replaced serves as a negative break on the GDP line by forestalling potential “growth”. Put simply, keeping things working is bad for the economy, whilst replacing them as frequently as possible is good for the economy, so long as we only obsess about the GDP line.

In extremis this leads to a very bizarre situation. To explain this, we need to look at profit. My definition of profit is that it is a source of energy, usually expressed in financial terms, that partially liberates us from the current cycle of tasks we must perform to meet our ongoing needs. That liberated energy can be used to buy time. To free up time to explore new and innovative ways of meeting needs more effectively. This research and development time, in turn, leads to improvements in the technological base that underpins the production of the things and processes we need to meet our needs. In short, profit provides surplus energy to purchase resources that enable us to research more effective ways of meeting needs and embedding the fruits of that process in the production of technology and infrastructure that we then call the means of production.

Profit, therefore, is essential if we are to evolve our civilisation and ourselves, and economics is the methodology we use to track whether this evolution is successfully taking place. This evolution can also be measured by the sum total of needs that are being met, both by physical and non-physical means, and the effectiveness in terms of the resources of time and materials deployed in accurately and comprehensively meeting those needs. [5] Without the generation of profit we only have what we already have, and we cannot progress or evolve either as individuals or collectively, not least because we don’t have the time to do so, being thereby forced to spend our time meeting our most basic needs as well as we can, given the less than optimal asset base at our disposal.

Given that we need to generate profit the question then becomes how do we generate that profit in a healthy way and what happens to that profit once it has been generated? What is it used for? In a healthy three-fold economy, which is what I am calling the proposed new system, profit is re-invested into the system of meeting needs with the universally agreed goal of meeting as many of the needs as possible for the most people [6] In the two-fold economy the primary purpose is to grow the economy on the assumption that this will meet more needs but, because it is only the accumulation of economic exchanges and the profit margins this generates that is considered important when judging the state of the economy, a disconnect arises between perceived economic health and the effective meeting of needs within the economy.

In the two-fold economy its perfectly possible for the economy to look like it is growing (and therefore healthy) whilst actually meeting fewer and fewer real needs for less and less people. This is precisely the state we are now in with regards to the current global economic system. The real economy is getting worse and worse for an increasing number of people and for the natural environment even whilst, on paper, the economy appears to be doing well in terms of GDP. [7]

This disconnect between sale, profit and the effective meeting of needs means that profits can be spent on anything so long as they increase the GDP line, which is why so much can be spent on company dividends and upper management bonuses, rather than being re-invested in real infrastructure that meets the widest number of individual needs. This increasing divorce from profit and the fact that the state of the collective asset base is deteriorating, whilst profit continues to increase, is not leading to better lives, but rather the opposite. [8]

Furthermore this process seems to be rapidly accelerating, and is why an increasingly smaller number of people are becoming increasingly wealthy at the expense of everyone else. Why invest in new schools, hospitals and theatres, or long-lasting kettles when you can be lauded for simply increasing a company’s personal GDP line in a quarterly profit report? Its far easier to use two-fold economic mechanisms to scam the real three-fold economy than it is to make investments that will benefit the wider community or the environment.

What we now have is a global economy that conflates production and profit without the need to produce anything of value to anyone other than the small group of beneficiaries of this two-fold system.

The Current production-driven two-fold economic system.

Introducing the Alternative

So, what’s the alternative?

Changing the entire macro-economic system from the top down is out because the vested interests who are addicted to its perpetuation are the ones who are running the system, along with the increasingly co-opted legislation-setting political class. With a few noble exceptions, wealthy people, large corporations, and governments are at the back of the que when it comes to re-invigorating a heathy three-fold economy. The changes we need are going to have to be initiated from the ground up, from within local communities that have a strong stake in their locality, the local environment, and the people living there.

So, what does such a system look like and how can it be implemented?

Let us return to our original three-way characterisation between production, the resource base and consumption. The first task is to reverse the flow in this triptych. At the moment production is seen as the first and most important element, especially when it triggers a sale and a profit, regardless of whether that profit meets a real need or degrades the collective asset base (means of production). What we need is a system that puts the health of the asset base first, followed by an account of how well that asset base is at meeting real needs and, only if that is not the case, is production of new asset material and a production value/sale generated.

In other words, it’s only if we can’t meet our needs from the existing asset base that we need to trigger new production. Increased production therefore becomes an indicator of a failing economy, rather than a successful one. An ongoing growth of overall production should tell us that our current asset base is becoming worse at meeting our needs, or that our needs are growing in such a way that the existing asset base is inadequate to meet those needs. In either case it should be the efficiency of the asset base that is the measure of how healthy the economy is, rather than production-triggered financial exchanges. A financial exchange should only take part when something needs changing. (Improving or replacing).

I just want to emphasise the point that it is our manufactured asset base that is the real and substantial source of our wealth. This consists of all the artefacts of our civilisation, both personal and collective, from our favourite mug to motorways; from the tools of production to the digitally stored blueprints on how things work. This asset base itself is built upon the foundations of multiple iterations of earlier asset-based infrastructure, stretching back some 10,000 years and more. It is the sum total of all our technologies and techniques for making things that are useful to human beings, along with all of the currently existing useful artefacts in the world.

Unless we want to start from scratch, the existing asset base is necessary to facilitate both consumption and further production. Including the asset base as a vital component of the economic equation is the third element in our three-fold economy, along with consumption and production.

So, what’s the alternative?

Changing the entire macro-economic system from the top down is out because the vested interests who are addicted to its perpetuation are the ones who are running the system, along with the increasingly co-opted legislation-setting political class. With a few noble exceptions, wealthy people, large corporations, and governments are at the back of the que when it comes to re-invigorating a heathy three-fold economy. The changes we need are going to have to be initiated from the ground up, from within local communities that have a strong stake in their locality, the local environment, and the people living there.

So, what does such a system look like and how can it be implemented?

Let us return to our original three-way characterisation between production, the resource base and consumption. The first task is to reverse the flow in this triptych. At the moment production is seen as the first and most important element, especially when it triggers a sale and a profit, regardless of whether that profit meets a real need or degrades the collective asset base (means of production). What we need is a system that puts the health of the asset base first, followed by an account of how well that asset base is at meeting real needs and, only if that is not the case, is production of new asset material and a production value/sale generated.

In other words, it’s only if we can’t meet our needs from the existing asset base that we need to trigger new production. Increased production therefore becomes an indicator of a failing economy, rather than a successful one. An ongoing growth of overall production should tell us that our current asset base is becoming worse at meeting our needs, or that our needs are growing in such a way that the existing asset base is inadequate to meet those needs. In either case it should be the efficiency of the asset base that is the measure of how healthy the economy is, rather than production-triggered financial exchanges. A financial exchange should only take part when something needs changing. (Improving or replacing).

I just want to emphasise the point that it is our manufactured asset base that is the real and substantial source of our wealth. This consists of all the artefacts of our civilisation, both personal and collective, from our favourite mug to motorways; from the tools of production to the digitally stored blueprints on how things work. This asset base itself is built upon the foundations of multiple iterations of earlier asset-based infrastructure, stretching back some 10,000 years and more. It is the sum total of all our technologies and techniques for making things that are useful to human beings, along with all of the currently existing useful artefacts in the world.

Unless we want to start from scratch, the existing asset base is necessary to facilitate both consumption and further production. Including the asset base as a vital component of the economic equation is the third element in our three-fold economy, along with consumption and production.

The assets story

Assets don’t last forever. They get used up (consumed) or otherwise deteriorate over time [9] There are five main reasons why an asset might no longer be useful:

As a general principle we may assume that an asset is constantly being consumed, from the moment of its creation until it is no longer serving its purpose. The time it takes for various assets to be consumed varies enormously, from two minutes for a glass of milk to five years for a washing machine, and 100 or more years for a house.

The overall utility value that any given asset provides is of only marginal importance to the two-fold economy and, in the extreme version of the two-fold economy is regarded as a negative value, but to the three-fold economy an assets utility value is central to the whole notion of a successful economy.

Assets don’t last forever. They get used up (consumed) or otherwise deteriorate over time [9] There are five main reasons why an asset might no longer be useful:

- It becomes redundant and is superseded by a new type of asset that meets needs more efficiently.

- Its mechanical tolerance levels are breached, and it breaks and is no longer able to perform its function.

- It suffers external damage and is broken

- It is lost or otherwise can not be found when needed

- We decide that our needs have changed, and we no longer require the asset in question.

As a general principle we may assume that an asset is constantly being consumed, from the moment of its creation until it is no longer serving its purpose. The time it takes for various assets to be consumed varies enormously, from two minutes for a glass of milk to five years for a washing machine, and 100 or more years for a house.

The overall utility value that any given asset provides is of only marginal importance to the two-fold economy and, in the extreme version of the two-fold economy is regarded as a negative value, but to the three-fold economy an assets utility value is central to the whole notion of a successful economy.

How does efficient use of assets contribute to economic success?

In the current two-fold model, which is mesmerised by the totem of the GDP measure, economic success is measured by the total volume of new assets that enter the marketplace and are subsequently sold. Whether the useful asset base is grown or diminished is largely irrelevant.

In principle there are two overriding reasons why an asset may no longer be viable. Either it is superseded by a better asset (an internal combustion car being replaced by and electric car) or it is perfectly functional but is made unusable by misfortune. (The shiny new electric car hits a lamppost and needs to be written off) The first type of change is initiated by rational human agency (i.e. is the consequence of intelligent rational decision making), whilst the second is initiated by environmentally induced misfortune. In the three-fold economy the new unmet need and the triggered production is an indication of healthy positive economic activity (we have learned how to do things better), whilst the second is an indication of unhealthy negative economic activity (we were careless and now must recreate what we have inadvertently lost.

The financial exchange that enables the replacement of the first type of asset is a genuine net benefit to the economy and can rightly appear on the economic balance sheet as a gain (due to its value added). In the case of the second type of asset replacement, it is a net loss to the economy, because the productive value of the original asset, although sound, has been lost due to destruction or neglect and needs to be unnecessarily replaced. This should appear as a loss on the economic balance sheet.

Unfortunately, with the two-fold GDP system this is not the case. Assuming those needing the ‘broken’ asset can afford to replace it, the financial transaction this facilitates is seen as a positive activity on the GDP balance sheet, even though it is a consequence of misfortune. [10]

We could call this Tragic Production as contrasted with Mindful Production.

By shifting the emphasis of the economy from production driven consumption, with no meaningful reference to the existing asset base, to consumption that is facilitated by the existing and improving asset base, we are in a position to build a new economic system which uses an entirely new form of metrics and measurement to determine its overall health and the health of all its individual components (businesses, individuals, households, non-human life-forms and other operational entities). Furthermore, this a form of measurement that prioritises the state of human need and human infrastructure over mere transactional profit.

In the current two-fold model, which is mesmerised by the totem of the GDP measure, economic success is measured by the total volume of new assets that enter the marketplace and are subsequently sold. Whether the useful asset base is grown or diminished is largely irrelevant.

In principle there are two overriding reasons why an asset may no longer be viable. Either it is superseded by a better asset (an internal combustion car being replaced by and electric car) or it is perfectly functional but is made unusable by misfortune. (The shiny new electric car hits a lamppost and needs to be written off) The first type of change is initiated by rational human agency (i.e. is the consequence of intelligent rational decision making), whilst the second is initiated by environmentally induced misfortune. In the three-fold economy the new unmet need and the triggered production is an indication of healthy positive economic activity (we have learned how to do things better), whilst the second is an indication of unhealthy negative economic activity (we were careless and now must recreate what we have inadvertently lost.

The financial exchange that enables the replacement of the first type of asset is a genuine net benefit to the economy and can rightly appear on the economic balance sheet as a gain (due to its value added). In the case of the second type of asset replacement, it is a net loss to the economy, because the productive value of the original asset, although sound, has been lost due to destruction or neglect and needs to be unnecessarily replaced. This should appear as a loss on the economic balance sheet.

Unfortunately, with the two-fold GDP system this is not the case. Assuming those needing the ‘broken’ asset can afford to replace it, the financial transaction this facilitates is seen as a positive activity on the GDP balance sheet, even though it is a consequence of misfortune. [10]

We could call this Tragic Production as contrasted with Mindful Production.

By shifting the emphasis of the economy from production driven consumption, with no meaningful reference to the existing asset base, to consumption that is facilitated by the existing and improving asset base, we are in a position to build a new economic system which uses an entirely new form of metrics and measurement to determine its overall health and the health of all its individual components (businesses, individuals, households, non-human life-forms and other operational entities). Furthermore, this a form of measurement that prioritises the state of human need and human infrastructure over mere transactional profit.

The proposed utility-value driven three-fold economic system.

Where does nature fit into the equation?

If we extend the definition of our infrastructure/asset-base to include the natural world, then we automatically begin to include the overall wellbeing of the biosphere within our definition of an extended asset base.

This extended asset base then has two parts; the human created infrastructure and the ‘infrastructure’ of the natural living world. As the increasing volatility of the natural worlds weather systems (due to the effects of climate change) is a primary cause of human asset destruction then, by adopting the operating and accounting methods of the threefold economy, and extending them to embrace living natural systems, we align the need to meet human and planetary needs, and have an economic system that measures our success at meeting these needs within a single integrated system, rather than is currently the case with the two-fold economy, where the success of the economy is at the expense of meeting the needs of people and the planet.

In this context the real economy is the set of globally and individually agreed needs that need to be met and the assets are the entirety of the mid-section of the economic triptych as outlined above (i.e. the existing asset base, of community and personal infrastructure).

If we extend the definition of our infrastructure/asset-base to include the natural world, then we automatically begin to include the overall wellbeing of the biosphere within our definition of an extended asset base.

This extended asset base then has two parts; the human created infrastructure and the ‘infrastructure’ of the natural living world. As the increasing volatility of the natural worlds weather systems (due to the effects of climate change) is a primary cause of human asset destruction then, by adopting the operating and accounting methods of the threefold economy, and extending them to embrace living natural systems, we align the need to meet human and planetary needs, and have an economic system that measures our success at meeting these needs within a single integrated system, rather than is currently the case with the two-fold economy, where the success of the economy is at the expense of meeting the needs of people and the planet.

In this context the real economy is the set of globally and individually agreed needs that need to be met and the assets are the entirety of the mid-section of the economic triptych as outlined above (i.e. the existing asset base, of community and personal infrastructure).

The underlying premise of the threefold economy

Having established that the current economic model is broken, because it is measuring the wrong outputs, whilst accelerating the destruction of good outputs (meaningful creation) in favour of the creation of bad outputs (more destruction) what then do we replace it with?

What I propose is an economic system that focusses on the middle portion of the tryptic, namely the asset base. We don’t live in a growth-based world. The collective living system of the Planet is not endlessly growing. It is arguably becoming richer and more diverse over time and, whilst growth is one side of its primary grow/decay mechanism the two elements exist in a dynamic balance with each other and serve as regulators for a system that strives to remain in overall balance (homeostasis) for as long as possible. In other words, the earths biosphere and mineral sphere strive to grow the number of possibilities for life to express itself, but it does not itself grow. We are not growing more land. We are not growing more water. The amount of minerals within the planet are stable and finite (unless we add more through meteoric bombardment). The atmosphere is not growing further out into space. These are all highly stable quantities. The composition of the gasses in the atmosphere is stable (with the ignoble exception of the increase in carbon dioxide and methane caused by human-induced industrial growth which, incidentally, needs to be seen as a perverse anti-growth metric).

The threefold economic system attempts to mimic the success of the earths living biosphere, whereby new life (production) contributes to the diversity of the overall asset base (the entirety of the biosphere) with most of the exchanges taking place within the living asset base. The components of any assets that are destroyed (by being eaten, or otherwise dying) are rapidly integrated within the system to create new assets (new life forms). The two essential components of the most successful living operating system we know of are expressed diversity within a system that maintains overall stability to an astounding degree. This is the maxim that we need to adopt regarding the threefold economic system.

The Earths biosphere might represent the ONLY successful perpetual living system in the universe, so it behoves us to not be so arrogant as to think we can come up with something that works better and that puts itself in opposition to it. [11] That means taking a leaf out of nature’s book and coming up with a human economic system that more closely mimics the natural life-maintaining systems [12] on the very good example we inhabit and which floats in the frozen inhospitable vacuum of space.

Having established that the current economic model is broken, because it is measuring the wrong outputs, whilst accelerating the destruction of good outputs (meaningful creation) in favour of the creation of bad outputs (more destruction) what then do we replace it with?

What I propose is an economic system that focusses on the middle portion of the tryptic, namely the asset base. We don’t live in a growth-based world. The collective living system of the Planet is not endlessly growing. It is arguably becoming richer and more diverse over time and, whilst growth is one side of its primary grow/decay mechanism the two elements exist in a dynamic balance with each other and serve as regulators for a system that strives to remain in overall balance (homeostasis) for as long as possible. In other words, the earths biosphere and mineral sphere strive to grow the number of possibilities for life to express itself, but it does not itself grow. We are not growing more land. We are not growing more water. The amount of minerals within the planet are stable and finite (unless we add more through meteoric bombardment). The atmosphere is not growing further out into space. These are all highly stable quantities. The composition of the gasses in the atmosphere is stable (with the ignoble exception of the increase in carbon dioxide and methane caused by human-induced industrial growth which, incidentally, needs to be seen as a perverse anti-growth metric).

The threefold economic system attempts to mimic the success of the earths living biosphere, whereby new life (production) contributes to the diversity of the overall asset base (the entirety of the biosphere) with most of the exchanges taking place within the living asset base. The components of any assets that are destroyed (by being eaten, or otherwise dying) are rapidly integrated within the system to create new assets (new life forms). The two essential components of the most successful living operating system we know of are expressed diversity within a system that maintains overall stability to an astounding degree. This is the maxim that we need to adopt regarding the threefold economic system.

The Earths biosphere might represent the ONLY successful perpetual living system in the universe, so it behoves us to not be so arrogant as to think we can come up with something that works better and that puts itself in opposition to it. [11] That means taking a leaf out of nature’s book and coming up with a human economic system that more closely mimics the natural life-maintaining systems [12] on the very good example we inhabit and which floats in the frozen inhospitable vacuum of space.

A quick recap

To briefly recap: What does the threefold human economic system look like? It needs to be centred on the middle part of the economic triptych of production, maintenance and consumption. And it needs to be focussed on maintaining an infrastructure base that genuinely optimises the meeting of as many genuine needs as possible as efficiently as possible. This means tagging the generation of primary economic values onto the existing asset base, which is the entirety of all human created artefacts, infrastructure, and systems, including the collective knowledge base, rather than on sales and production levels of new things.

To briefly recap: What does the threefold human economic system look like? It needs to be centred on the middle part of the economic triptych of production, maintenance and consumption. And it needs to be focussed on maintaining an infrastructure base that genuinely optimises the meeting of as many genuine needs as possible as efficiently as possible. This means tagging the generation of primary economic values onto the existing asset base, which is the entirety of all human created artefacts, infrastructure, and systems, including the collective knowledge base, rather than on sales and production levels of new things.

A new metric for establishing economic value

At the moment there are no direct ways of valuing these assets unless they are pulled into the orbit of production and consumption and thereby trigger an economic exchange. I therefore propose a new metric of value which, simply put, allows assets to accumulate a store of value based on how effectively they are at meeting real needs before needing to be replaced. I believe that this can form the foundation for a genuine circular economy, which currently lacks a viable universally agreed operational mechanism.

So, how do we create a metric that will serve as a new form of economic measurement and tell us how well we are doing at optimising the meeting of human needs within a stable system? I will now give an example of how we value the efficiency of assets at meeting needs within this new threefold system.

At the moment there are no direct ways of valuing these assets unless they are pulled into the orbit of production and consumption and thereby trigger an economic exchange. I therefore propose a new metric of value which, simply put, allows assets to accumulate a store of value based on how effectively they are at meeting real needs before needing to be replaced. I believe that this can form the foundation for a genuine circular economy, which currently lacks a viable universally agreed operational mechanism.

So, how do we create a metric that will serve as a new form of economic measurement and tell us how well we are doing at optimising the meeting of human needs within a stable system? I will now give an example of how we value the efficiency of assets at meeting needs within this new threefold system.

|

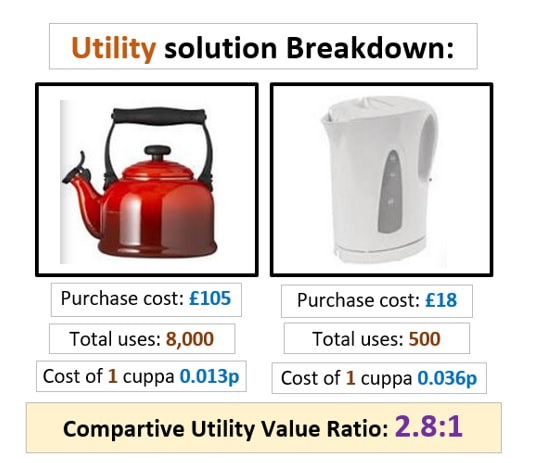

(If I buy a new kettle (kettle A) for £20 and get 1,000 hot drinks from it before it needs replacing then the total asset value, to the ’consumer’ (I prefer asset user) becomes the cost of the kettle divided by the number of drinks it facilitates, which gives a unit cost per drink of £20.00 divided by 1,000, which is £0.02. If I buy a better kettle (kettle B) that costs £40, and I get 5,000 drinks from it, then the use value is £40 divided by 5,000 or £0.008 per drink. This makes the cost per use (drink) provided by kettle A £0.02 contrasted against the cost per use provided by kettle B, which is £0.008 per drink.

If we divide 0.02 by 0.008 we get 2.5, which means that, in spite of being double the initial purchase price, kettle B is 2.5 times more efficient at providing hot drinks than kettle A. (The illustration uses a slightly diffrent metric) |

We now have an objective measurement system that allows us to determine the efficiency of various elements of the asset base at meeting stated needs. In this case the need to have a hot drink.

Furthermore, this new unit of value combines both production cost and profit, as determined by the sale price, and utility value cost, as determined by the total use value over the lifetime of the asset.

We can now say that kettle B performs 2.5 times better than kettle A. This gives us a multiplier effect [13] for the relative efficiency of comparable assets. in their ability to meet needs. We can also translate this into percentages. Kettle A is only 40% as efficient as kettle B and, conversely, kettle B is 150% more efficient than kettle A.

If we scale this process of accounting for effective use value up across the entire asset economy, we end up with an economy based on use value which is every bit as dynamic and complex as the twofold nature of the existing economy.

Furthermore, this new unit of value combines both production cost and profit, as determined by the sale price, and utility value cost, as determined by the total use value over the lifetime of the asset.

We can now say that kettle B performs 2.5 times better than kettle A. This gives us a multiplier effect [13] for the relative efficiency of comparable assets. in their ability to meet needs. We can also translate this into percentages. Kettle A is only 40% as efficient as kettle B and, conversely, kettle B is 150% more efficient than kettle A.

If we scale this process of accounting for effective use value up across the entire asset economy, we end up with an economy based on use value which is every bit as dynamic and complex as the twofold nature of the existing economy.

The further implications of applying the use value formula

Out of the threefold economic system two new directions of travel emerge against which we can measure our economic success:

Firstly, extending the useful life of performing assets until they need to be replaced becomes the way we add MORE to the economic sum, not LESS and secondly, the decisions about how to upgrade the means of production rest, first and foremost with the users of those assets, whose needs are being directly met by the functionality of those assets.

We now have a way of measuring economic success that is user led (needs being met) and which seeks to make the ever increasingly efficient needs fulfilling asset base the primary thing that gets measured, and which, in turn, defines the overall health of the economy. Conventional sales transactions therefore become indicators of change within the economy, which can be analysed as to the nature of those changes. The general trend of exchanges in a healthy threefold economic system, both in terms of volume and price, would be downwards, with large upward swings being indicators of an economy in trouble, which is the very opposite of what we currently have with the GDP measure.

In the threefold system profit margins, in principle, can remain unaffected by the shift from twofold accounting. What matters now is where and how those profits are re-invested. Also, the level of profit will be influenced by the imperative of enhancing the efficiency of the collective asset base, rather than personally enriching a self-selecting few, whose main talent is in knowing how to game the real economy by applying the accounting tricks that the twofold economy affords. It is far harder to hide one’s activities when the impact of one's actions are formally measured against the good or harm they do to the collective commons. (Be this privately or publicly owned).

Instead of GDP, we would be using a steady state system of measurement that keys human needs and planetary needs into one integrated accounting system that has the overall stability of the entire system, both human and environmental, as its primary goal.

The most elegant example of what such a metric would look like is encapsulated in the “Doughnut Economy” model of Kate Raworth [14] where systemic stability and the meeting of human and planetary needs is represented by the green zone of the doughnut and the generation of unmet needs of planet and people are represented in the two red zones outside the doughnut. (Insert illustration) The Doughnut Economy model therefore provides a good framework from which to build a new dynamic accounting system.

Out of the threefold economic system two new directions of travel emerge against which we can measure our economic success:

Firstly, extending the useful life of performing assets until they need to be replaced becomes the way we add MORE to the economic sum, not LESS and secondly, the decisions about how to upgrade the means of production rest, first and foremost with the users of those assets, whose needs are being directly met by the functionality of those assets.

We now have a way of measuring economic success that is user led (needs being met) and which seeks to make the ever increasingly efficient needs fulfilling asset base the primary thing that gets measured, and which, in turn, defines the overall health of the economy. Conventional sales transactions therefore become indicators of change within the economy, which can be analysed as to the nature of those changes. The general trend of exchanges in a healthy threefold economic system, both in terms of volume and price, would be downwards, with large upward swings being indicators of an economy in trouble, which is the very opposite of what we currently have with the GDP measure.

In the threefold system profit margins, in principle, can remain unaffected by the shift from twofold accounting. What matters now is where and how those profits are re-invested. Also, the level of profit will be influenced by the imperative of enhancing the efficiency of the collective asset base, rather than personally enriching a self-selecting few, whose main talent is in knowing how to game the real economy by applying the accounting tricks that the twofold economy affords. It is far harder to hide one’s activities when the impact of one's actions are formally measured against the good or harm they do to the collective commons. (Be this privately or publicly owned).

Instead of GDP, we would be using a steady state system of measurement that keys human needs and planetary needs into one integrated accounting system that has the overall stability of the entire system, both human and environmental, as its primary goal.

The most elegant example of what such a metric would look like is encapsulated in the “Doughnut Economy” model of Kate Raworth [14] where systemic stability and the meeting of human and planetary needs is represented by the green zone of the doughnut and the generation of unmet needs of planet and people are represented in the two red zones outside the doughnut. (Insert illustration) The Doughnut Economy model therefore provides a good framework from which to build a new dynamic accounting system.

A fully free, demand-led economy

The threefold economy does not stifle demand, as all agents (people, orgs etc) having demands upon the asset base (needs) are entirely free to make choices as to what those needs are, based upon their own individual and collective circumstances. What is different is that the underlying economic system in which those choices are embedded now rewards choices that make good uses of or improvements to the asset base, whilst choices that undermine the asset base are poorly rewarded, if at all. A person will therefore become wealthier by virtue of the clever ways in which they reduce the strain on the asset base whilst meeting all their stated needs, and a poor person will be one whose activities make inefficient use of the asset base and make poor choices in terms of its overall improved state. Thus, the stated free choice that is so critical to the current proponents of the twofold economy are completely preserved in the threefold economy, whilst having the diametrically opposite effect. i.e. we have free markets that gradually move us towards ever greater overall stability, through the encouragement of smart choices, rather than one that moves us towards ever greater systemic instability, through the encouragement of dumb choices.

The threefold economy does not stifle demand, as all agents (people, orgs etc) having demands upon the asset base (needs) are entirely free to make choices as to what those needs are, based upon their own individual and collective circumstances. What is different is that the underlying economic system in which those choices are embedded now rewards choices that make good uses of or improvements to the asset base, whilst choices that undermine the asset base are poorly rewarded, if at all. A person will therefore become wealthier by virtue of the clever ways in which they reduce the strain on the asset base whilst meeting all their stated needs, and a poor person will be one whose activities make inefficient use of the asset base and make poor choices in terms of its overall improved state. Thus, the stated free choice that is so critical to the current proponents of the twofold economy are completely preserved in the threefold economy, whilst having the diametrically opposite effect. i.e. we have free markets that gradually move us towards ever greater overall stability, through the encouragement of smart choices, rather than one that moves us towards ever greater systemic instability, through the encouragement of dumb choices.

The Threefold Economy characterised within the context of the Circular Economy

This threefold system firmly incentivised the creation of genuinely useful circular flows of goods, materials, ideas and other assets in a series of perpetual use cycles, in which the ‘classic’ linear input (new production) and output (discarded assets) ends of the pipe are much diminished and replaced with circular flows of material and non-material resources which, over time transform and upgrade the overall utility base through ever more efficient ‘bootstrapping’ via a quantifiable methodology for assessing the value of those re-use, recycling, repurposing, re-manufacturing techniques that are given a higher numerical, and thereby higher financial, value the less they and their components are degraded and made unusable.

This threefold system firmly incentivised the creation of genuinely useful circular flows of goods, materials, ideas and other assets in a series of perpetual use cycles, in which the ‘classic’ linear input (new production) and output (discarded assets) ends of the pipe are much diminished and replaced with circular flows of material and non-material resources which, over time transform and upgrade the overall utility base through ever more efficient ‘bootstrapping’ via a quantifiable methodology for assessing the value of those re-use, recycling, repurposing, re-manufacturing techniques that are given a higher numerical, and thereby higher financial, value the less they and their components are degraded and made unusable.

Enhanced Self-expression and self-development of the Individual

In order to become ever mindful about the way we use ‘stuff’ [15] we must become ever more mindful as individuals; we need to develop personal faculties that allow us to intelligently look ahead into the future before we commit to an action (the meeting of a need) in order to anticipate the best possible pathway for meeting that need through whatever particular actions we choose to take. (INSERT LINK TO ARTICLE OF THE DEVELOPMENT OF THE MINDFULLNESS ECONOMY HERE) Unlike the physical environment, which is massively over-used, the fulfilment of human potential is massive under-utilised and yet the two are linked. The more mindful our behaviour, the more we are likely to value the physical infrastructure over which we have agency, the more options we will have available to consider and the more opportunities we will spot for enhancing the meaning and satisfaction that our lives afford us.

The metric for measuring a person’s level of experienced meaning can be measured in a way similar to the way that GDP is measured, in which an ever-ascending upwards curve would represent success in helping as many human beings find meaning and fulfilment in their lives. Such a Gross National Happiness (GNH) index [16] or a Gross Achieved Meaning Evaluation (GAME) will have a completely different methodology for gathering the relevant data that is profoundly person-centred. Details on how this can work are covered elsewhere.

In order to become ever mindful about the way we use ‘stuff’ [15] we must become ever more mindful as individuals; we need to develop personal faculties that allow us to intelligently look ahead into the future before we commit to an action (the meeting of a need) in order to anticipate the best possible pathway for meeting that need through whatever particular actions we choose to take. (INSERT LINK TO ARTICLE OF THE DEVELOPMENT OF THE MINDFULLNESS ECONOMY HERE) Unlike the physical environment, which is massively over-used, the fulfilment of human potential is massive under-utilised and yet the two are linked. The more mindful our behaviour, the more we are likely to value the physical infrastructure over which we have agency, the more options we will have available to consider and the more opportunities we will spot for enhancing the meaning and satisfaction that our lives afford us.

The metric for measuring a person’s level of experienced meaning can be measured in a way similar to the way that GDP is measured, in which an ever-ascending upwards curve would represent success in helping as many human beings find meaning and fulfilment in their lives. Such a Gross National Happiness (GNH) index [16] or a Gross Achieved Meaning Evaluation (GAME) will have a completely different methodology for gathering the relevant data that is profoundly person-centred. Details on how this can work are covered elsewhere.

Investment vehicles within the threefold economy

By reversing the dynamics of flow of the economic system, to prioritise a viably functioning asset base over new production, we can begin to shift the emphasis from selling objects to selling services. If we have a business model that relies on selling carpets and floor coverings then the relative success or failure of the business is measured by the amount of floor coverings we sell, regardless of what happens to them once sold. If, on the other hand, we base our business model on the selling of floor coverings as a service then we are incentivised to produce floor coverings with maximum durability and a minimum maintenance cycle. This will profit us more than merely providing more and more floor coverings.

The threefold economy introduces a measurable mechanism for measuring asset durability that we can use to usher in entirely new forms of investment vehicle based on the right to use an asset, once it has been created and made available. In other words, once a need has been identified and the business case for it (according to the rules of the threefold economy) is proved, then investors pay for the production of that asset until it is ready to use and then hold rights of use which can be traded like any other investment commodity.

In this needs-driven economy we have a reversed dynamic wherein identified needs are searching for the most efficient meeters of those needs, rather than the delivers having to ‘create’ a market in which to sell the products that they, as producers, have decided to make. This reduces risk (risk comes in the assets ability to deliver its stated goals (and the needs it meets) along with the overall life span of that asset.)

Investment risk will apply at the asset development (manufacturing) stage and at the applied use value stage, with greater returns the longer the use frequency periods (applied rights to use) endure. Or, to put it another way, the longer the asset lasts and the more need cycles it satisfies, the greater the profit to the investor in the sale of right to use 'certificates'.

The enhanced contextualising of our actions will also reduce investment risk, as sound investment decisions are more likely the more information is shared into the system, rather than by being determined by how much information is withheld.

By reversing the dynamics of flow of the economic system, to prioritise a viably functioning asset base over new production, we can begin to shift the emphasis from selling objects to selling services. If we have a business model that relies on selling carpets and floor coverings then the relative success or failure of the business is measured by the amount of floor coverings we sell, regardless of what happens to them once sold. If, on the other hand, we base our business model on the selling of floor coverings as a service then we are incentivised to produce floor coverings with maximum durability and a minimum maintenance cycle. This will profit us more than merely providing more and more floor coverings.

The threefold economy introduces a measurable mechanism for measuring asset durability that we can use to usher in entirely new forms of investment vehicle based on the right to use an asset, once it has been created and made available. In other words, once a need has been identified and the business case for it (according to the rules of the threefold economy) is proved, then investors pay for the production of that asset until it is ready to use and then hold rights of use which can be traded like any other investment commodity.

In this needs-driven economy we have a reversed dynamic wherein identified needs are searching for the most efficient meeters of those needs, rather than the delivers having to ‘create’ a market in which to sell the products that they, as producers, have decided to make. This reduces risk (risk comes in the assets ability to deliver its stated goals (and the needs it meets) along with the overall life span of that asset.)

Investment risk will apply at the asset development (manufacturing) stage and at the applied use value stage, with greater returns the longer the use frequency periods (applied rights to use) endure. Or, to put it another way, the longer the asset lasts and the more need cycles it satisfies, the greater the profit to the investor in the sale of right to use 'certificates'.

The enhanced contextualising of our actions will also reduce investment risk, as sound investment decisions are more likely the more information is shared into the system, rather than by being determined by how much information is withheld.

The need for new kinds of organisational frameworks

The threefold economic system has profound implications for existing types of organisational frameworks that have been built around the dynamics of the twofold economic system and which, in the context of supporting, underpinning, and delivering the threefold economy, are not fit for purpose. This means that new kinds of organisational frameworks that will have to develop around this new economic dynamic, with the emphasis on meeting efficient needs within an overall environment of human stability whilst providing a healthy level of overall homeostasis. They will have to be far more open with information sharing and proprietorship (who owns what) and in the collaborative organisational and administration structures that they adopt.

Rather than existing within ever increasing silos of specialisation, these new organisational structures will arise as necessary, out of the working collaborative teams of people tasked with (old public sector) or inspired with (old private sector) the task of delivering certain assets and asset combinations.

The functional usefulness of all organisations is time limited and, just like all living-dynamic forms, have a ‘sell-by-date’. All objects have their own momentum and organisations, as a particular class of objects, have their own momentum too. This makes them subject to institutional inertia, often tempting them to hang on well past their ‘sell-by date’.

In the dynamic process-driven threefold economy the clearly stated purpose of an organisation will pre-define the time limited nature of an organisation, which will be governed by the same principle underlying the existence of all useful assets, namely that the form (of the organisational or asset structure) will follow function (what need it is there to fulfil), rather than function being distorted by outdated, dysfunctional or inappropriate forms which, be definition, provide less efficient utility measurements., and thus invite themselves to be replaced or superseded.

Because organisational frameworks and assets both share, in their functionality, the meeting of needs, this makes organisational constructs just another class of asset. Just like the existing economic system. And, as with all other asset types and classes, production is driven by need and not vice versa.

The threefold economic system has profound implications for existing types of organisational frameworks that have been built around the dynamics of the twofold economic system and which, in the context of supporting, underpinning, and delivering the threefold economy, are not fit for purpose. This means that new kinds of organisational frameworks that will have to develop around this new economic dynamic, with the emphasis on meeting efficient needs within an overall environment of human stability whilst providing a healthy level of overall homeostasis. They will have to be far more open with information sharing and proprietorship (who owns what) and in the collaborative organisational and administration structures that they adopt.

Rather than existing within ever increasing silos of specialisation, these new organisational structures will arise as necessary, out of the working collaborative teams of people tasked with (old public sector) or inspired with (old private sector) the task of delivering certain assets and asset combinations.

The functional usefulness of all organisations is time limited and, just like all living-dynamic forms, have a ‘sell-by-date’. All objects have their own momentum and organisations, as a particular class of objects, have their own momentum too. This makes them subject to institutional inertia, often tempting them to hang on well past their ‘sell-by date’.

In the dynamic process-driven threefold economy the clearly stated purpose of an organisation will pre-define the time limited nature of an organisation, which will be governed by the same principle underlying the existence of all useful assets, namely that the form (of the organisational or asset structure) will follow function (what need it is there to fulfil), rather than function being distorted by outdated, dysfunctional or inappropriate forms which, be definition, provide less efficient utility measurements., and thus invite themselves to be replaced or superseded.

Because organisational frameworks and assets both share, in their functionality, the meeting of needs, this makes organisational constructs just another class of asset. Just like the existing economic system. And, as with all other asset types and classes, production is driven by need and not vice versa.

Getting started and scaling up

Being a needs-based approach to marketing the threefold economic system starts with an individual need and scales up and aggregates from that point, rather than being a universal overarching top-down system in which the individual has to fit into, more or less (and increasingly less) successfully. This means that it can be introduced at a micro-scale in many places simultaneously for multiple instances of asset-user arrangements, which can then gradually be aggregated into a comprehensively larger system that applies the core dynamic elements outlined in this article.

Literally any increased utility applied to any artefact will create a viable threefolding economic system element, so long as the formula of production cost value to aggregated use value is applied and documented.

Another fortunate effect of the threefold system is that it actively works against the creation of supplier monopolies because it is fundamentally user led and fundamentally bottom up rather than top down. This dynamic should contribute to an increase in overall market competitiveness (competing to provide the best collaborative and integrated solutions), rather than precipitating the generation of economic dis-economies [17] that inappropriate levels of scale currently ‘provide’. [18]

Being a needs-based approach to marketing the threefold economic system starts with an individual need and scales up and aggregates from that point, rather than being a universal overarching top-down system in which the individual has to fit into, more or less (and increasingly less) successfully. This means that it can be introduced at a micro-scale in many places simultaneously for multiple instances of asset-user arrangements, which can then gradually be aggregated into a comprehensively larger system that applies the core dynamic elements outlined in this article.

Literally any increased utility applied to any artefact will create a viable threefolding economic system element, so long as the formula of production cost value to aggregated use value is applied and documented.

Another fortunate effect of the threefold system is that it actively works against the creation of supplier monopolies because it is fundamentally user led and fundamentally bottom up rather than top down. This dynamic should contribute to an increase in overall market competitiveness (competing to provide the best collaborative and integrated solutions), rather than precipitating the generation of economic dis-economies [17] that inappropriate levels of scale currently ‘provide’. [18]

To Summarise

With the threefold economic system and with reference to the economic asset base, collective economic wealth is ultimately measured by the increase in options available for making efficiency changes that optimise benefits within an increasingly stable system. These increased options, when triggered, by expressed demand (an expressed need) then call up the production side of the equation. In this system the priority order is reversed. Improving the asset base stimulates need/consumption which, in turn, stimulates production, rather than in the existing twofold economic system, whereby continually accelerating production, and measuring all success on production output, means that the effects upon the actual asset base and the needs it meets is effectively disregarded.

With the effectively unregulated evolution of novel financial products since the “Big Bang” of the mid-eighties [19] it is now possible to show a ‘healthy’ return on investments that are materially damaging both the human and environmental infrastructure systems, and this is seen as an economic good, when using conventional measure of economic success such as GDP and quarterly company profit declarations.

In order to antidote this toxic situation, the threefold economy model seeks to provide metrics that require the wise use of assets and the most efficient meeting of overall needs. In practice these new metrics align economic success with the meeting of the maximum number of needs using the minimum amount of newly generated physical assets in order to incentivise an ever-increasing virtual spiral of human and environmental system stability.

This new asset-based accounting system actively reverses the direction of travel from the production of ever more stuff for ever less genuine utility (the economy grows at the expense of both people and planet) to one that measures economic success in terms of how little new stuff has to be produced to meet more and more genuine needs.

It also inserts into the economic equation the personal subjective experiences and realities of all its living human agents and not only recognises the critical value that enhancing human experience and self-awareness plays but also makes a causal link between the growth of the non-material human capacity building and the driving of efficiencies within the physical asset base.

With the threefold economic system and with reference to the economic asset base, collective economic wealth is ultimately measured by the increase in options available for making efficiency changes that optimise benefits within an increasingly stable system. These increased options, when triggered, by expressed demand (an expressed need) then call up the production side of the equation. In this system the priority order is reversed. Improving the asset base stimulates need/consumption which, in turn, stimulates production, rather than in the existing twofold economic system, whereby continually accelerating production, and measuring all success on production output, means that the effects upon the actual asset base and the needs it meets is effectively disregarded.

With the effectively unregulated evolution of novel financial products since the “Big Bang” of the mid-eighties [19] it is now possible to show a ‘healthy’ return on investments that are materially damaging both the human and environmental infrastructure systems, and this is seen as an economic good, when using conventional measure of economic success such as GDP and quarterly company profit declarations.

In order to antidote this toxic situation, the threefold economy model seeks to provide metrics that require the wise use of assets and the most efficient meeting of overall needs. In practice these new metrics align economic success with the meeting of the maximum number of needs using the minimum amount of newly generated physical assets in order to incentivise an ever-increasing virtual spiral of human and environmental system stability.

This new asset-based accounting system actively reverses the direction of travel from the production of ever more stuff for ever less genuine utility (the economy grows at the expense of both people and planet) to one that measures economic success in terms of how little new stuff has to be produced to meet more and more genuine needs.

It also inserts into the economic equation the personal subjective experiences and realities of all its living human agents and not only recognises the critical value that enhancing human experience and self-awareness plays but also makes a causal link between the growth of the non-material human capacity building and the driving of efficiencies within the physical asset base.

Michael Hallam : 27 July 2022

Developing the Model Further

Notes and Refferences

[1] In a perfectly free market the two items exchanged between the parties would be of equal or equivalent value. i.e., I pay what I think the product/service is worth and you receive payment for what you think the product/service is worth. In other words, we have an agreement on the price and what is being sold for that price.

[2] An economic event is here defined as a need being met, and a profit is an amount to facilitate further production of needed items to be made in the future. In other words, profit builds future capacity.

[3] GDP. Gross Domestic Product https://www.investopedia.com/terms/g/gdp.asp

[4] What gets measured in GDP https://www.gov.uk/government/news/gross-domestic-product-gdp-what-it-means-and-why-it-matters

[5] I contend that the ultimate Universal need that needs to be met is the need for Meaning. But that is the subject of another essay.

[6] Adam Smiths famous maxim of using the market economy to most efficiently distribute resources to meet the maximum number of needs for the maximum number of people. This is the foundational basis of modern economics. Neo-liberal economists argue that the best way to do this is to leave it to the invisible hand of the market but, if the market only has hands and no heart will it really be able to fulfil its stated purpose? https://www.lgt.com/en/magnet/financial-markets/the-invisible-hand-and-the-magic-of-the-market/#button1

[7] See “The Trouble with GDP” The Economist 30 April 2016 https://www.economist.com/briefing/2016/04/30/the-trouble-with-gdp

[8] See “Profits Without Prosperity” William Lazonick https://hbr.org/2014/09/profits-without-prosperity

[9] See: “The temporal fragility of infrastructure: Theorizing decay, maintenance, and repair” - Kavita Ramakrishnan, Kathleen O’Reilly, Jessica Budds. https://journals.sagepub.com/doi/10.1177/2514848620979712

[10] See: “Disaster Capitalism: The Shock doctrine “ Naomi Klein https://en.wikipedia.org/wiki/The_Shock_Doctrine

[11] Setting aside the increased human suffering this causes; economy versus nature the ‘suffering’ of the natural world should give us real cause for concern, as it is the primary source of all the materials we need to survive. Furthermore, most of those materials need to be in a living state to be of use. If this trend was taken to its inevitable (without intervention) conclusion we could summarise the current economic system as one which inflicts the maximum harm (or "ilth" in the words of John Ruskin" upon the maximum number of people (not to mention the wider living world). This negative process has now truly taken hold of the economy at a global level and is being accelerated by economies of capital scale, whereby available financial capital attracts more capital, like a financial gravitational well, which gives more agency to the process of asset stripping which is increasingly taking possession of the real economy See also: “Economics' failure over destruction of nature presents ‘extreme risks” Larry Elliott and Damian Carrington https://www.theguardian.com/environment/2021/feb/02/economics-failure-over-destruction-of-nature-presents-extreme-risks

[12] Nature has a habit of attempting to reclaim everything where the structural integrity is not inhabited and defended. The structural integrity of more complex elemental compositions, beyond simple mineral compositions are maintained by living systems/beings. Most of the things that we find useful, like all of our food and many of our raw materials come from other life-forms, without which we would perish very quickly.

[13] The local multiplier effect: https://www.nefconsulting.com/what-we-do/evaluation-impact-assessment/local-multiplier-3/

[14] Kate Raworth’s doughnut economy model: https://www.kateraworth.com/doughnut/

[15] See “The Story of Stuff” by Annie Leonard https://www.storyofstuff.org/about/

[16] Gross National Happiness: https://sustainabledevelopment.un.org/index.php?page=view&type=99&nr=266&menu=1449

[17] See: “Saving money by doing the right thing: Why ‘local by default’ must replace ‘diseconomies of scale’ “ Locality report: https://locality.org.uk/wp-content/uploads/2018/03/Locality-Report-Diseconomies-updated-single-pages-Jan-2017.pdf

[18] See: “Too Big to Fail: The New Monopoly” https://seekingalpha.com/article/241778-too-big-to-fail-the-new-monopoly

[19] The 1986 Big Bang (in financial markets) https://en.wikipedia.org/wiki/Big_Bang_(financial_markets)

[1] In a perfectly free market the two items exchanged between the parties would be of equal or equivalent value. i.e., I pay what I think the product/service is worth and you receive payment for what you think the product/service is worth. In other words, we have an agreement on the price and what is being sold for that price.

[2] An economic event is here defined as a need being met, and a profit is an amount to facilitate further production of needed items to be made in the future. In other words, profit builds future capacity.

[3] GDP. Gross Domestic Product https://www.investopedia.com/terms/g/gdp.asp

[4] What gets measured in GDP https://www.gov.uk/government/news/gross-domestic-product-gdp-what-it-means-and-why-it-matters

[5] I contend that the ultimate Universal need that needs to be met is the need for Meaning. But that is the subject of another essay.

[6] Adam Smiths famous maxim of using the market economy to most efficiently distribute resources to meet the maximum number of needs for the maximum number of people. This is the foundational basis of modern economics. Neo-liberal economists argue that the best way to do this is to leave it to the invisible hand of the market but, if the market only has hands and no heart will it really be able to fulfil its stated purpose? https://www.lgt.com/en/magnet/financial-markets/the-invisible-hand-and-the-magic-of-the-market/#button1

[7] See “The Trouble with GDP” The Economist 30 April 2016 https://www.economist.com/briefing/2016/04/30/the-trouble-with-gdp

[8] See “Profits Without Prosperity” William Lazonick https://hbr.org/2014/09/profits-without-prosperity

[9] See: “The temporal fragility of infrastructure: Theorizing decay, maintenance, and repair” - Kavita Ramakrishnan, Kathleen O’Reilly, Jessica Budds. https://journals.sagepub.com/doi/10.1177/2514848620979712

[10] See: “Disaster Capitalism: The Shock doctrine “ Naomi Klein https://en.wikipedia.org/wiki/The_Shock_Doctrine